16+ Monthly mortgage

The Math Behind Our Mortgage Calculator. Incoterms 2020 is the ninth set of international contract terms published by the International Chamber of Commerce with the first set having been published in 1936.

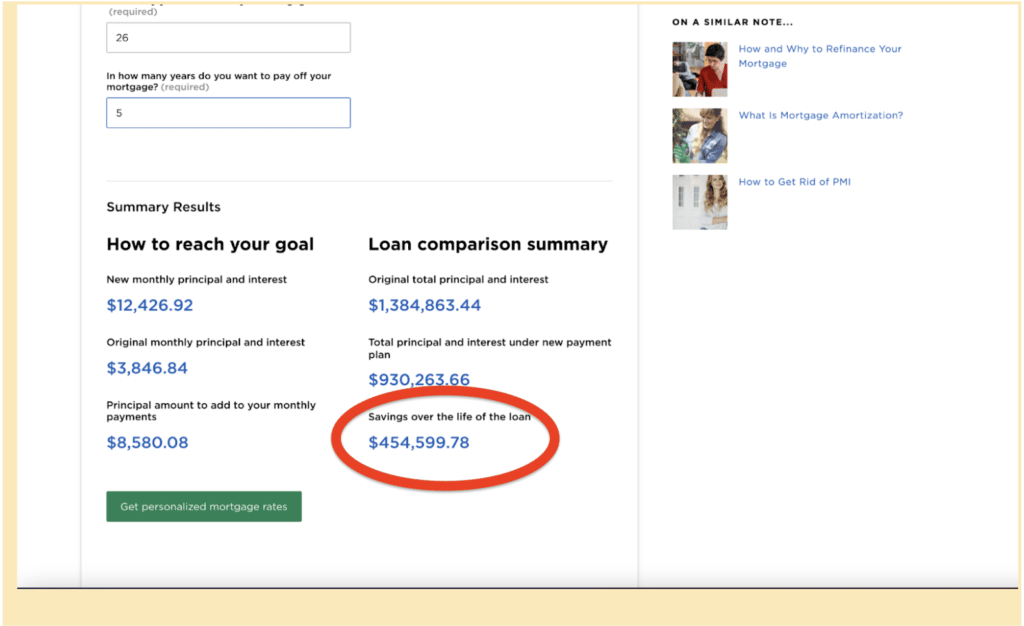

Ways To Pay Off Your Mortgage Early And Why We Did It

After the grace period which ends on the 16 th of the month your mortgage payment will be considered late with fees and likely negative effects on your credit.

. When a borrower is obligated on a non-mortgage debt - but is not the party who is actually repaying the debt - the lender may exclude the monthly payment from the borrowers recurring monthly obligations. Incoterms 2020 defines 11 rules the same number as defined by Incoterms 2010. Scan down the interest rate column to a given interest rate such as 7.

Compare and see which option is better for you after interest fees and rates. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. The process is usually clear-cut once you call the phone number you will be instructed to follow.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. The formula used to calculate monthly principal and interest mortgage payments is. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

NEW Mortgage Rates Little-Changed at Recent Highs - Mortgage Rate Watch Tue 332 PM Todays mortgage rates are roughly in line with yesterdays for the average lender. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

Below is the monthly mortgage insurance premium MIP calculation with examples and pseudocode using the annual and upfront MIP rates in effect for mortgages assigned an FHA case number before October 4 2010. T Total number of payments term of loan in months. Not a member yet.

Regardless of whether or not the other party is making the monthly mortgage payments. P Monthly payment amount. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 47742 a month while a 15-year might cost 73969 a month.

One rule of the 2010 version Delivered at Terminal. Second mortgages come in two main forms home equity loans and home equity lines of credit. Then follow across to the payment factor for either a 15 or 30 year term.

However the trade-off for that low payment is a significantly higher overall cost because the extra. Other costs and fees related to your mortgage may increase this number. You see at-a-glance where you stand.

V Loan amount. The main factors determining your monthly mortgage payments are the size and term of the loan. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in 1981. M Monthly Payment. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 449 monthly payment.

See the monthly cost on a 250000 mortgage over 15- or 30-years. This free online calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D.

Second mortgage types Lump sum. How mortgage rates have changed over time. Size is the amount of money you borrow and the term is the length of time you have to pay it back.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. N Monthly interest rate as a decimal This is the annual interest rate divided by 12. The formula for calculating monthly mortgage insurance premium became effective May 1 1998 see Mortgagee Letter 98-22 Attachment.

Get all the latest India news ipo bse business news commodity only on Moneycontrol. N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage. The phone number of your lender will be located online and on your monthly bill.

And you can drill down into each factor so you can easily monitor whats. For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations. P Principal Amount initial loan balance i Interest Rate.

A thorough analysis of the monthly budget. Using The Mortgage Payment Table. Your report card gives you a letter grade in each of the five key factors of your credit.

The 30-year mortgage is the most popular choice because it offers the lowest monthly payment. This is a monthly payment factor table showing monthly principal and interest payments per 1000. The monthly cost for a 200000 mortgage was about 1200 per month not including taxes and insurance.

Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted. Post 2008 rates declined steadily.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Assuming you have a 20 down payment 25000 your total mortgage on a 125000 home would be 100000.

P Vn1 nt1 nt - 1 Where. For example a 6 APR becomes 0. The average monthly mortgage payments for first-time buyers putting down a 10 per cent deposit have climbed past 1000 for the first time according to property site Rightmove today.

The average mortgage rate in 1981 was 1663 percent. DAT was removed and is replaced by a new rule Delivered at. In effect you will be making one extra mortgage payment per year -- without hardly noticing the additional cash outflow.

16 Monthly Budget Templates Word Pdf Excel Free Premium Templates

Cost Of Living Majority Of Mortgage Holders Walking A Thin Line As Interest Rate Begins To Rise Angus Reid Institute

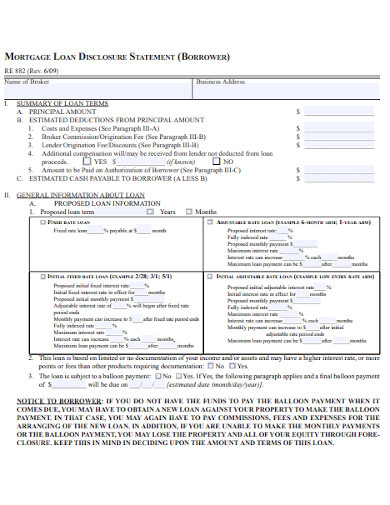

Free 16 Mortgage Agreement Contract Samples Templates In Pdf Ms Word

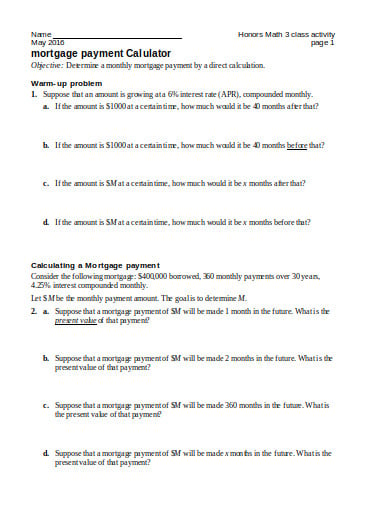

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

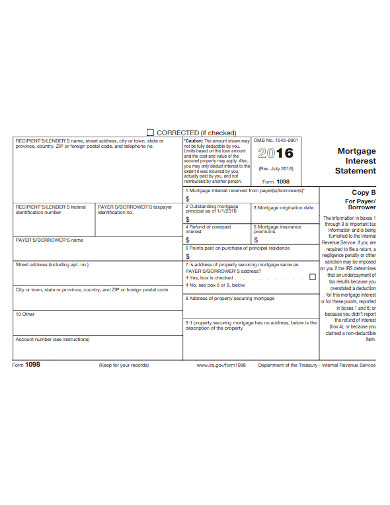

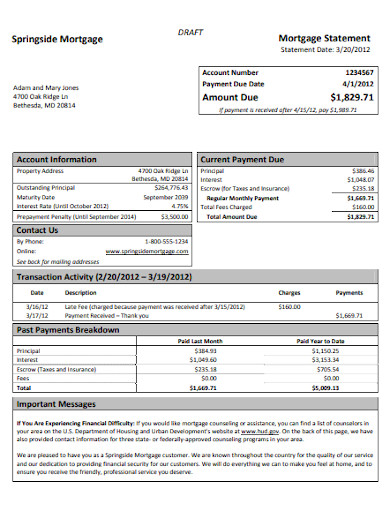

Mortgage Statement 10 Examples Format Pdf Examples

16 Free Payment Agreement Templates Examples Docformats Com

16 Free Weekly Budget Templates Ms Office Documents Weekly Budget Template Budget Template Budgeting

Cost Of Living Majority Of Mortgage Holders Walking A Thin Line As Interest Rate Begins To Rise Angus Reid Institute

Ways To Pay Off Your Mortgage Early And Why We Did It

Cost Of Living Majority Of Mortgage Holders Walking A Thin Line As Interest Rate Begins To Rise Angus Reid Institute

Mortgage Statement 10 Examples Format Pdf Examples

Cost Of Living Majority Of Mortgage Holders Walking A Thin Line As Interest Rate Begins To Rise Angus Reid Institute

Mortgage Statement 10 Examples Format Pdf Examples

Mortgage Statement 10 Examples Format Pdf Examples

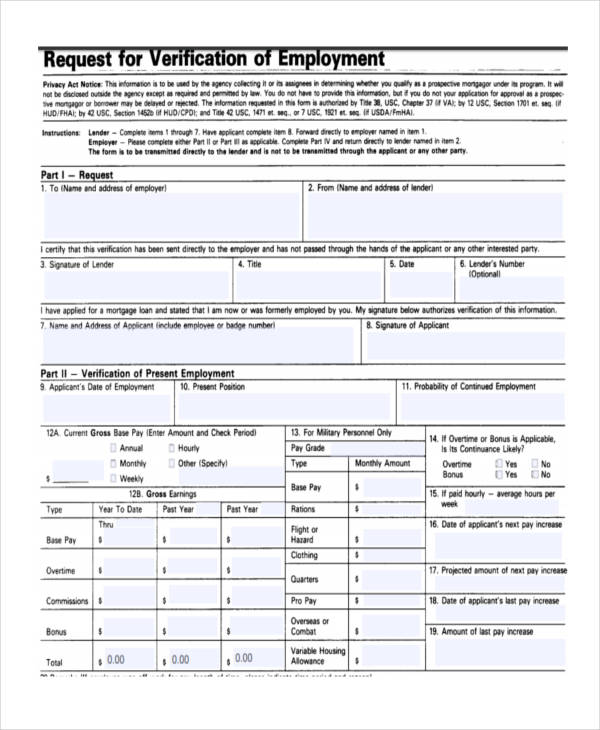

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

Is Paying Off Your Mortgage Better Than Contributing To An Rrsp Ratehub Ca

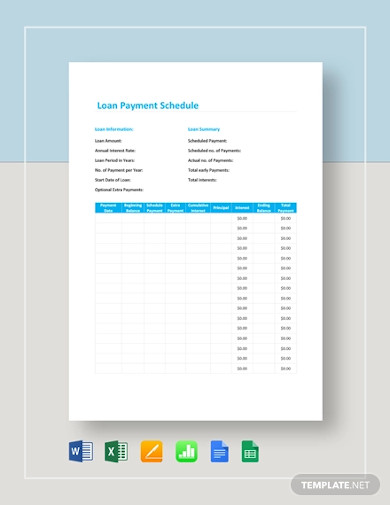

16 Loan Schedule Templates In Google Docs Google Sheets Xls Word Numbers Pages Free Premium Templates